Legal Accounting

We Assist Law Firms With The

Accounting Process

We can assist you through the many steps of the accounting process. Time and billing management is a necessary task for all attorneys, regardless of practice specialty and firm size. Time, Billing and Accounting software organizes time management, budgeting, client billing and the general ledger. If you or your firm would like to take the guesswork out of your billing and accounting preparation, consider our services.

Some Features and Functions of Time, Billing and Accounting software are:

Time Tracking

Tracks billable time; some programs may create reports for individual billing attorneys; Billable time can be recorded on an hourly, contingent, transactional, or user defined fee individually or firm-wide.

Bill Preparation /Accounts Receivable

Generates client invoices from firm's billable time records; Immediate access to client's overall balance; Records payments to client accounts; Some programs allow for a customizable bill design and easy conversions to PDF format, and secure delivery of bills via email.

General Ledger/Accounts Payable

Manage your firm's business; Records payments to vendors; Helps prepare mandatory IRS filings; Some programs have a check writing feature.

Trust Accounting

Manages clients' deposits on services not yet rendered. A lawyer should hold property of others with the care required of a professional fiduciary.

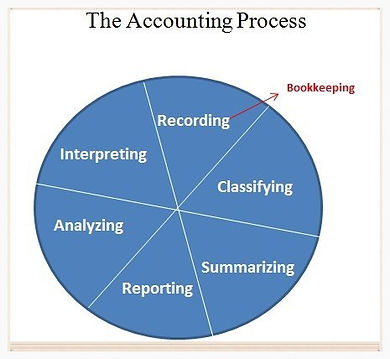

Accounting Process

Accounting is an information system that includes the process of recording, classifying, summarizing, reporting, analyzing and interpreting the financial condition and performance of the firm – in order to communicate it to stakeholders for business decision making.

Works with Other Programs

Many time, billing and accounting programs are compatible with and can share data with email programs (Microsoft Outlook), financial accounting programs (QuickBooks), and Personal Digital Assistants.

Law Firm Financial Management Guide

GENERAL SETUP

Law firms can use two basic methods for keeping track of law firm financial performance: accrual and cash accounting.

-

Accrual records reflect income irrespective of whether cash has been collected. In other words, accrual accounting reflects billings, work in progress (completed but not yet billed) and accounts receivable (work billed but not yet collected).

-

Cash accounting, on the other hand, reflects only collections, never billings or work in progress. Almost all small law firms operate on a cash basis, accounting for cash as it comes in and goes out. Larger law firms maintain both cash and accrual records.

PROFITIBILITY

Law firms have a need for reports to gauge productivity and profitibility. Some of these reports include:

-

Income statements, also called profit and loss or P&L statements, tell how well a firm did financially in a given period of time. Income statements use the accrual method to tell how much revenue has been billed, how much expense has been accrued, and how much net income or profit resulted.

-

However, income or profit figures generally have little relevance to small law firms. Small professional service firms typically operate on a cash basis, with the lawyer's salary or draw coming from positive cash flow. For the smaller practitioner, the analysis of profitability is relatively simple because it is based on cash flow.

-

Within this scope, any attorney can create a personal P&L statement to document individual financial performance. The calculation is a basic one: billings - [total compensation + direct and indirect expenses] = net profit.

Financial analysis is a process of identifying and deducting the expenses of the practice from monthly cash received. Fixed expenses typically include: staff, including salaries and taxes; occupancy (rent, taxes, utilities); equipment (including depreciation); malpractice insurance; and outside professional services.

-

The largest single expense is the partner or shareholder's draw or salary. This reflects the lawyer's personal needs and style of living, and the most sensible practice is to increase it only as the firm's performance produces sufficient income to do so. Amounts set aside for savings and retirement should be approached similarly to salary.

REVENUE

All of this is dependent on revenue, which for a small practice can be variable. A good method for estimating it is the accounting measure of turnover ratio: accounts receivable balance divided by the result of billings per days in the billing period (either monthly or annually). The turnover ratio tells a lawyer to expect payment for billings X number of days after a client receives a statement.

-

The national average for law firms, according to one survey, is between 120 and 150 days - as much as five months. That means that a typical small firm should have funds sufficient to operate for at least six months without new billings coming in.

CONCLUSION

The lesson cannot be repeated too often: cash flow and collections are the crucial determinants of business performance for the solo or small-firm practice.